Ag Feed Supply Company B012

Established in the “Roaring Twenties”, this family owned feed and supply business has been successful and lucrative since its inception, and continues to excel in its market in Northeast Kansas. The business is well respected in its local community and enjoys a long standing relationship with many businesses including local 4h and animal holistic programs, local chambers of commerce, city and rotary groups, and large animal production facilities. Their diverse customer base has allowed them to generate and grow profit from existing clientele by simple word of mouth and online interaction. This local firm is recognized for its community efforts donating to local charities, and takes great pride in the presentation of its facilities. High modes of specialization allow the firm to take advantage of unique strengths and production capabilities which are difficult for outside firms to replicate. This allows them to produce demand driven precise proprietary feeds. Controlled use of growth stimulants, antibiotics, preservatives and other ingredients are applied based on animal species, age, sex (often in consultation with a nutritionist). Core consumers include; livestock owners, wildlife enthusiasts, and customers occupying small acreage farms in the area. The firm provides the ability to produce animal diets for many different species of farm animal. Outside of the core business function, the practice also provides a variety of services including; feed deliveries, feeding nutrition and advice, providing “chick days” and has a small full-equipped retail store for customers to browse through. The premises comes fully equipped with a feed mill possessing all of the following equipment; a Gravity Cleaner, Pellet Mill / Granulator, a Roller Mill, and Hammer Mill for the processing of feeds. Other equipment includes; a boiler system (for steam conditioning and heating of the pellet mill and roller mill), a dust collection tech system, a 3000lb capacity batch mixer, a hopper style scale, several platform scales, a liquid molasses mixer, 2 pellet jacks and a forklift. The facilities also are equipped with an outdoor truck scale (capacity 25 tons) plus bulk loading system for truck loading, as well as an automated bagging system, twenty indoor overhead bins allowing for packaging and quality controls through the automated systems. The business currently employs 8 staff; 5 full-time (including the owner) and 3 part-time employees. The owner is nearing retirement and is interested in selling the business within 1 ½ to 2 years and will stay on, in some capacity, to mentor a new owner and help transition the business. The business is housed an approximate 0.75 Acre piece of land located in a prime location and includes a finished product storage warehouse, feed mill, retail store and office, six large outdoor / 1,700 bushel bins, three 15,000 bushel bins and one 20,000 bushel bin. The real estate and facilities are owned by business and ideally these assets would transfer with the business through a purchase, lease-to-purchase or lease arrangement. Revenue is derived from three major categories; 60% is generated from commercial livestock feed, 20% is from the production of cleaned grains (including cut and steam rolled grains), and the final 20% from finished retail products purchased for resale. Possible growth / new investment opportunities exist by updating technology systems for bookkeeping and inventory and increasing marketing efforts and online presence. Additionally, the market for natural and organic feeds is expanding rapidly as are the number of local hobby farms. This firm is consistently cash flow positive with gross income over the past five years staying between $1.1 million and $1.3 million allowing for debt financing of a major remodel of the showroom and storage facilities. Net profit / income to the business is estimated to be more than $100K ($123K in 2014), representing a profit margin of 10% (in line with industry averages). Annual discretionary cash flow earnings to new owners, i.e. adjusted EBITDA, is estimated to be more than $175K, sufficient cash flow to a new owner to service any debt financing and receive a decent living wage. The estimated value range of this practice from operations is between $375K - $500K (excluding receivables, inventory, liabilities and facilities).

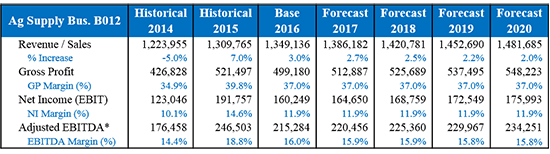

Expanded financial forecast (showing one additional year)

| Ag Supply Bus. B012 | Historical 2014 |

Base 2015 |

Forecast 2016 |

Forecast 2017 |

Forecast 2018 |

Forecast 2019 |

|---|---|---|---|---|---|---|

|

Revenue/Sales % Increase |

1,223,955 -5.0 |

1,309,765 7.0 |

1,349,136 3.0 |

1,386,182 2.7 |

1,420,781 2.5 |

1,452,690 2.2 |

|

Gross Profit GP Margin (%) |

426,828 34.9 |

521,497 39.8 |

499,180 37.0 |

512,887 37.0 |

525,689 37.0 |

537,495 37.0 |

|

Net Income (EBIT) NI Margin (%) |

123,046 10.1 |

191,757 14.6 |

160,249 11.9 |

164,650 11.9 |

168,759 11.9 |

172,549 11.9 |

|

Adjusted EBITDA* EBITDA Margin (%) |

176,458 14.4 |

246,503 18.8 |

215,284 16.0 |

220,456 15.9 |

225,360 15.9 |

229,967 15.8 |

* Adjusted EBITDA = EBIT plus Depreciation and Adjustments (excludes Owners compensation)